When you think of traditional forms of investments, fixed deposits definitely will cross your mind. For a long time, they have been a secure way of investing money with the least amount of risk involved. Simple rules govern fixed deposits as you place a lump sum amount for a specified term before you could withdraw your initial amount with interest which would be same through the till the deposit matures. In this investment, you earn on your funds without thinking about it much; once you have deposited till it is time for withdrawal. Market factors hardly impact your money in the fixed deposit except for inflation.

Several financial institutions happen to have this kind of scheme for their customers, and it is still one of the most popular forms of investments that people still go to. Now that we know what fixed deposits are, we need to know the consequences of withdrawal before completing the ‘lock-in period.’ You may not have to guess. Moreover, it definitely won’t be in your favor. However, circumstances may compel you to go for premature withdrawal of fixed deposits. It would help to be aware and what you may face. As we tell you in this article, potential investors will learn how to avoid breaking the fixed deposit or can even seek advice from Jwalantham Capital to make a better investment choice.

Understanding premature withdrawal of deposit

Sometimes circumstances may lead you to withdraw your fixed deposit before completing the mentioned term period. When you extract funds from the fixed deposits prior to maturity, it is termed as breaking the deposit or premature withdrawal of the deposit. You must know that it is permissive to withdraw when you need funds or have found better investment alternatives but have to comply with the terms of directives laid down by the RBI, which change from time to time.

Why is it that people want to withdraw deposits prematurely?

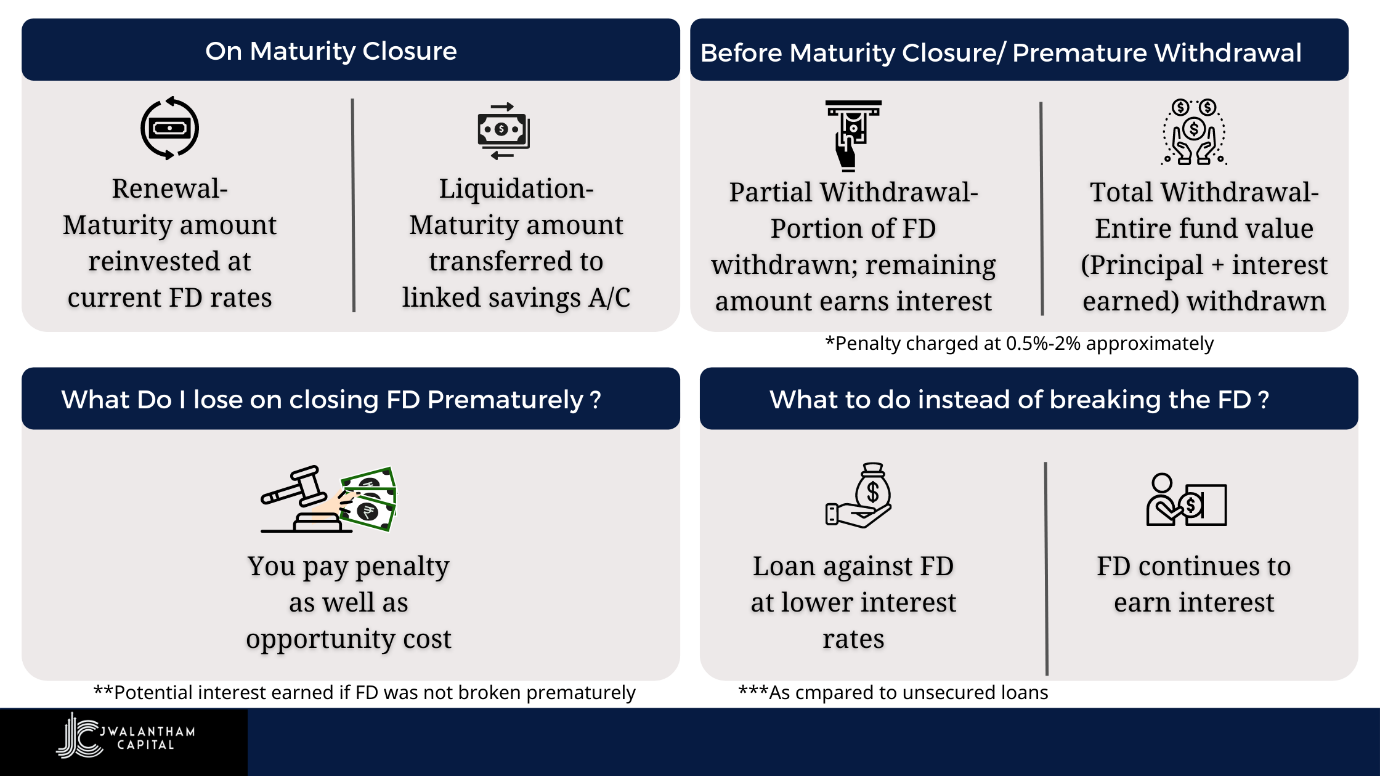

People may have quite a few reasons for abrupt fixed deposit withdrawals, such as emergencies or wanting to invest in instruments with a higher interest rate. This usually happens because the offered interest rate and the total sum of earnings are pretty much lower than other investment means. There are also chances when the depositor wants to withdraw the deposit schedule it in a new account to avail of the current fixed deposit rate, which may be higher. However, the bank authorities usually discourage this practice. They may fine the depositor for premature withdrawal of a fixed deposit up to 1% as a penalty which often is applied to the interest rates on the specified time period of the said deposit.

The rate of interest for a premature withdrawal of the deposit

The depositor will receive the same interest rate promised on the date of deposit, albeit with a penalty because of premature withdrawal. The bank will calculate the amount to be paid with interest from the day of deposit to the day of premature withdrawal of the fixed deposit.

In order to explain the premature deposit concept better, an example would justify my point. If a depositor deposits in a certain amount on March 10th of 2018 for a term period of five years at the rate of 8%, he wants to break the deposit prematurely the next year on June 10th of 2019. The opening year interest rate applicable for the first year of your fixed deposit term is 5.6%, and the remaining three months will be calculated at 8%. And finally, the penalty is deducted from the amount.

However, if the withdrawal happens before the prescribed minimum period as per the terms sheet, the depositor will get no interest on his deposit. Every bank has a different minimum lock-in period for different fixed deposit schemes.

Paying up for premature fixed deposit withdrawal

The penalty is not much. It can be 1% or lower than that; however, some banks waive the penalty in case of emergencies. Though emergencies differ and are determined case-to-case, not all situations call for a waiver. You also get a waiver if you are planning to reinvest in the same bank on a different fixed deposit scheme.

Premature fixed deposit withdrawal is not a good idea, as you might have seen because the depositor will end up with a lowered interest rate and a penalty to top it. The double loss is a big pinch for the investor. We can illustrate this with another example of another depositor who has a fixed deposit of 50,000 at the rate of 6% for 3 years. Suppose the FD is broken in 1.5 years. In that case, the interest applicable is lowered rate of interest of 5.25% – a penalty rate of interest of 1% = 4.25% resulting in 53,273.3. If the interest rate was 5.25%, the depositor would receive 54, 068.98 and 54,672.16 for 6%. (After compounding it quarterly. However, interest rates are compounded half-yearly and yearly in some term deposits as per policy rules.) Jwalantham Capital will make your fixed deposit calculations easier with a fixed deposit calculator that helps you find the maturity value and interest with just a click.

Will you be penalized with the same rate of interest in every bank?

The banks have the liberty to determine the penalty interest that they can charge on premature fixed deposit withdrawal. However, every bank needs to inform beforehand of the penalty interest charges before the depositor when they propose the deposit rates.

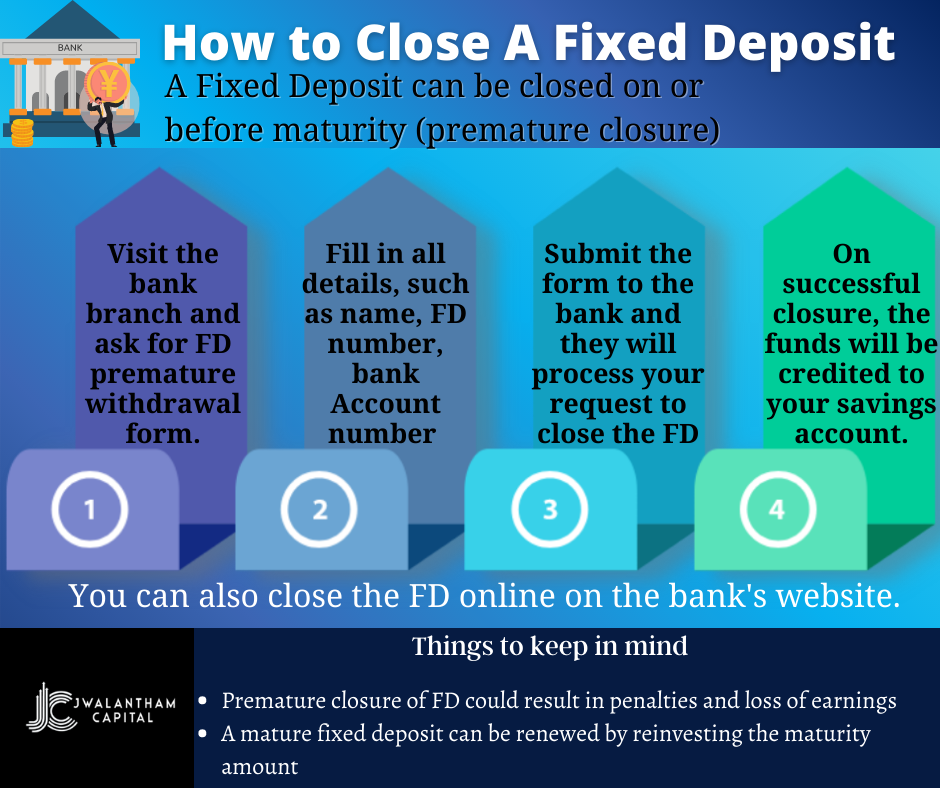

The procedure for premature withdrawal of fixed deposit

When the depositor wants to break a deposit, he must approach the bank with the fixed deposit certificate/receipt. And fill out a fixed deposit liquidation form duly signed by all account holders at the bank branch wherein the fixed deposit has been done. This process also can be done through net banking as well.

The right time for breaking a fixed deposit

There is always a wish to earn better and when you make term deposits or fixed deposits of your funds. You realize later on that you could have gotten a better rate if you had chosen another scheme that would have been lucrative. Think again. At times chasing a higher interest rate may not be a great idea.

This could be illustrated better with an example of a fixed deposit of 2,00,000 for five years for 5% interest earning you 2,50,000 over five years. However, you suddenly think of investing the premature withdrawal of a fixed deposit and placing it another term deposit of 8% after a two-year lapse. So, the withdrawn amount will cost you an interest rate applicable of 4.25 – 1% of penalty = 3.25%, to the rate of interest earned 65000. When the new FD begins from the 3rd year (5-2=3years) with a new interest rate of 8%, you will earn a loss of (65000-32000) 30,500. However, when the FD is relatively new. If you withdraw within 6 months, making the changeover will be a lucrative proposition. This reinvestment will be a good way to increase your earnings.

So, the decision to break an FD is based on the time-lapse of your FD. If it’s a relatively old FD or halfway or more into its term, breaking it would only cause a loss. Allowing it to mature for the full term would work out better. We can help you work out the math and help you make better decisions with your investments.

Jwalantham Capital’s team of experts advises you to find an alternative to premature fixed deposit withdrawal.

The best alternative suggested is to get a loan on your fixed deposit. It will help you pay lesser interest on the loan taken than a personal or credit loan you will apply for in the banks. You could easily avail yourself of 70 to 90% of your deposit as a loan or even an overdraft facility. The offered loan amount will vary from bank to bank and the FD amount. There is a chance of being offered a higher amount per your relationship with the bank and their policies.

What happens after availing of a loan on FD

A certain fee may be charged for loan processing. However, not all banks levy a fee on the depositor, and it may be waived off due to your association with the bank. The loan tenure shouldn’t exceed the term deposit period—a certain restriction to the depositor for not closing the deposit while you have availed a loan. There is also an option for the depositor to pay back the loan earlier with the help of other deposits in the bank if you find it difficult to repay the loan, leading to a case of default.

Payment & interest rates

If you want to settle your loan priorly, most banks don’t charge the depositor with preclosure fees. The depositor can fix the payment schedule for the loan by paying every month a fixed amount or decided by the terms of the bank as they may ask you to pay on a monthly basis or settle for the payment at the maturity of the FD. Also, while availing loan on FD, not much paperwork is involved in bogging you down, and the request will do to ensure quick access to funds.

You now have a fair idea of premature fixed deposit withdrawal, how it can impact your income, and the alternative you can choose. However, making investment decisions is straightforward, and you can avail yourself of guidance by contacting the team at Jwalantham Capital, which can keep your financial health sunny.